Here’s where financial companies in USA play a defining role. As per the latest figures in 2023, the US comprises 988,019 finance and insurance companies. These are involved with several aspects, such as providing a secure space to store money and lending funds to individuals with promising credit scores. Others are involved directly with businesses, helping them manage their funds and minimizing their financial risks.

Regardless of their role, it is vital to understand the dominating financial companies in the US market and analyze what sets them apart from others. Stay with us as we traverse through the top 15 on the list and discuss their strengths and USPs.

The Top Contenders: 15 Leading Financial Companies in USA

The largest financial companies in USA are organized in terms of the market cap and the revenue amassed in the latest fiscal years. Based on these inputs, here is a list of the dominating financial companies in the US:

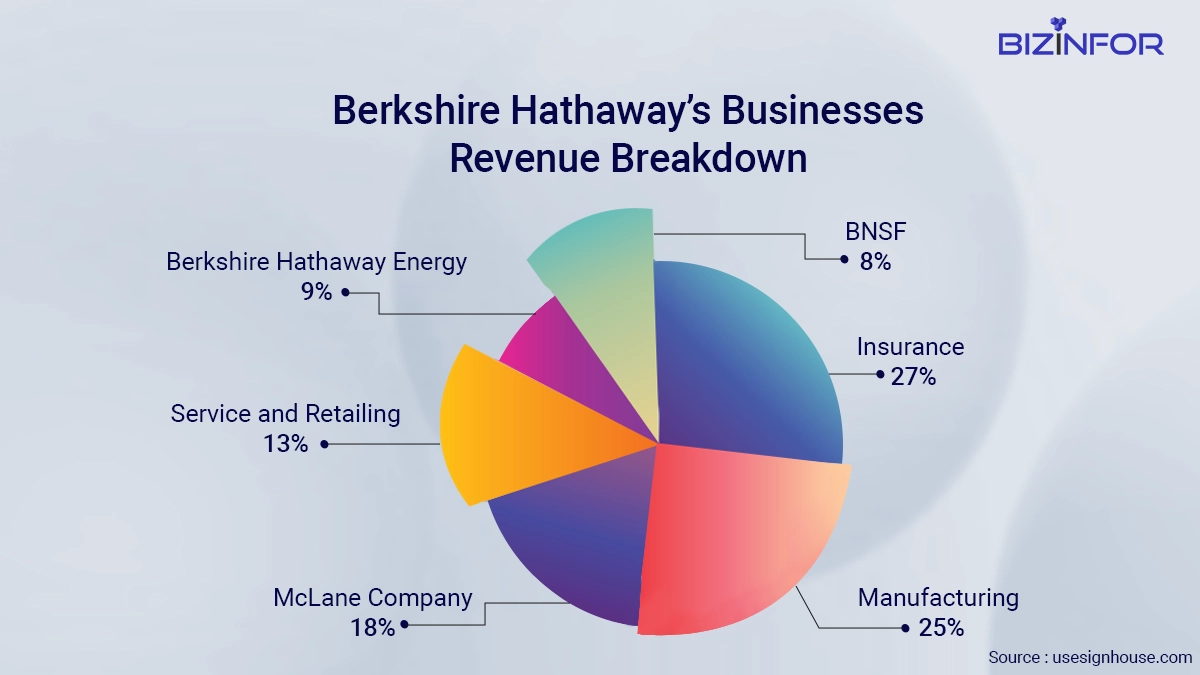

Berkshire Hathaway

- Headquarters: Omaha, Nebraska

- Market capitalization: USD 747.19 billion

- Revenue for 2022: USD 302.1 billion

Founded by Warren Buffet, Berkshire Hathaway is known for its insurance services. It has supplemented its reputation as an investing company and has significant shares in American Express, Apple, Bank of America, and Coca-Cola.

Strengths

- Robust financial position with no debts and increasing stakeholders

- Diverse business portfolio with stakes in established and budding companies

- Qualified workforce due to targeted efforts in upskilling and training

- Strong distribution channel to ensure maximum user satisfaction

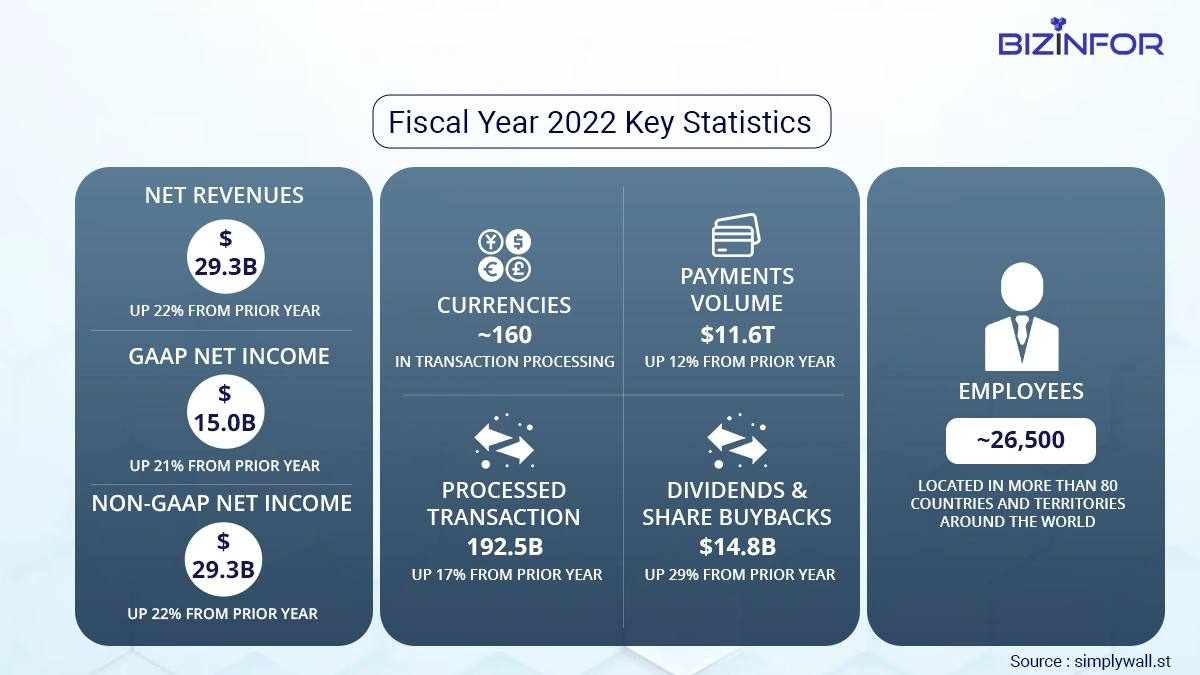

Visa Inc.

- Headquarters: San Francisco, California

- Market capitalization: USD 498.4 billion

- Revenue for 2022: USD 29.3 billion

Known for offering seamless digital payments worldwide, Visa Inc. comprises a collection of credit and debit cards offered by different banks. It is among the top names in payment technologies and leverages innovation to stand apart from the competition. Visa has become the top payment solution for merchants, financial institutions, and developers.

Strengths

- Widespread compatibility as a payment method throughout the world

- The payment structure is backed by secured Dossier Centres

- Ongoing and past endorsements with celebrated events like the Olympics and FIFA

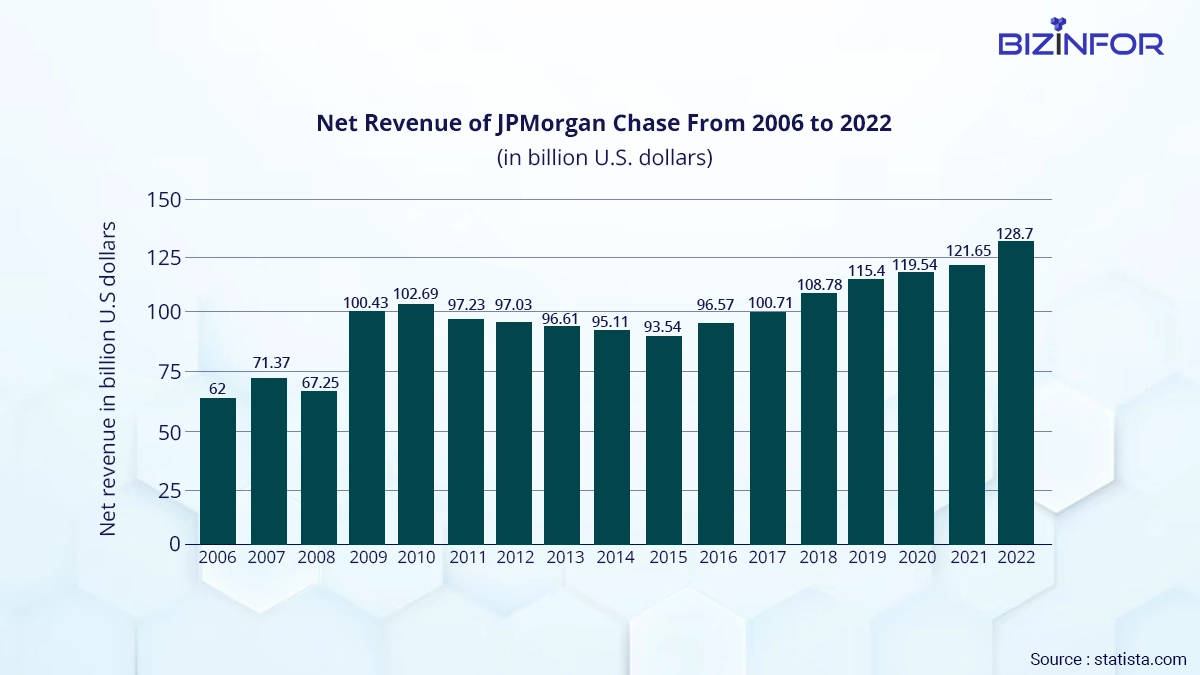

JP Morgan Chase & Co.

- Headquarters: New York

- Market capitalization: USD 428.43 billion

- Revenue for 2022: USD 128.7 billion

The business model of JP Morgan Chase & Co. focuses on multiple financial aspects, like investment banking, loans and other financial assistance for consumers and small businesses, and commercial banking. Their target audience spans consumers worldwide and government and corporate entities needing help with asset management.

Strengths

- Strong and expansive distribution network that covers a majority of their target markets

- Portfolio of diverse services that cater to varied needs of consumers and businesses

- Sustains a position as the largest bank in the United States

- Boasts an extensive retail network to boost customer experience

Mastercard Inc.

- Headquarters: Purchase, Harrison, New York

- Market capitalization: USD 373.32 billion

- Revenue for 2022: USD 22.2 billion

Second only to Visa, Mastercard Inc. is amongst the top companies in the payments space. It enables and powers digital transactions worldwide and aims to simplify payments worldwide. Their main business model is to collaborate with financial institutions, offer their payment network processor and issue Mastercard-operated payment cards.

Strengths

- Possesses high-profit margins on every transaction made through the network

- Robust presence in over 210 countries and compatible with 150 currencies

- Innovative publicity and marketing strategies that allow it to target emerging businesses

- Increased marketing automation has resulted in consistent quality and more efficiency

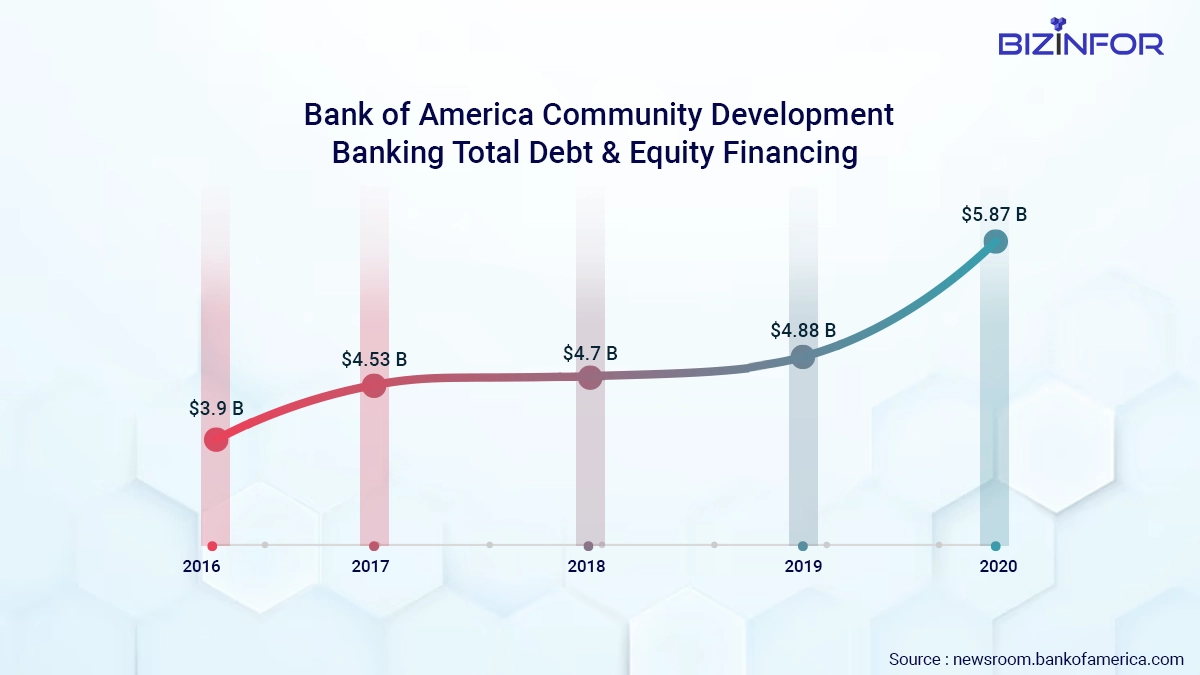

Bank of America Corporation

- Headquarters: Charlotte, North Carolina

- Market capitalization: USD 232.69 billion

- Revenue for 2022: USD 92.4 billion

Renowned as one of the top financial companies in USA, the Bank of America caters to diverse segments. Individuals, small businesses, and large enterprises can benefit from this institution’s various services. Plus, it is the world’s largest wealth management organization.

Strengths

- Caters to multiple markets and manages a diversified business model

- Surplus investment in digital technology to adapt to upcoming digitalization

- A vast network of ATMs and bank branches across the US to retain the customer base

- A renowned financial institution with a strong reputation in the market

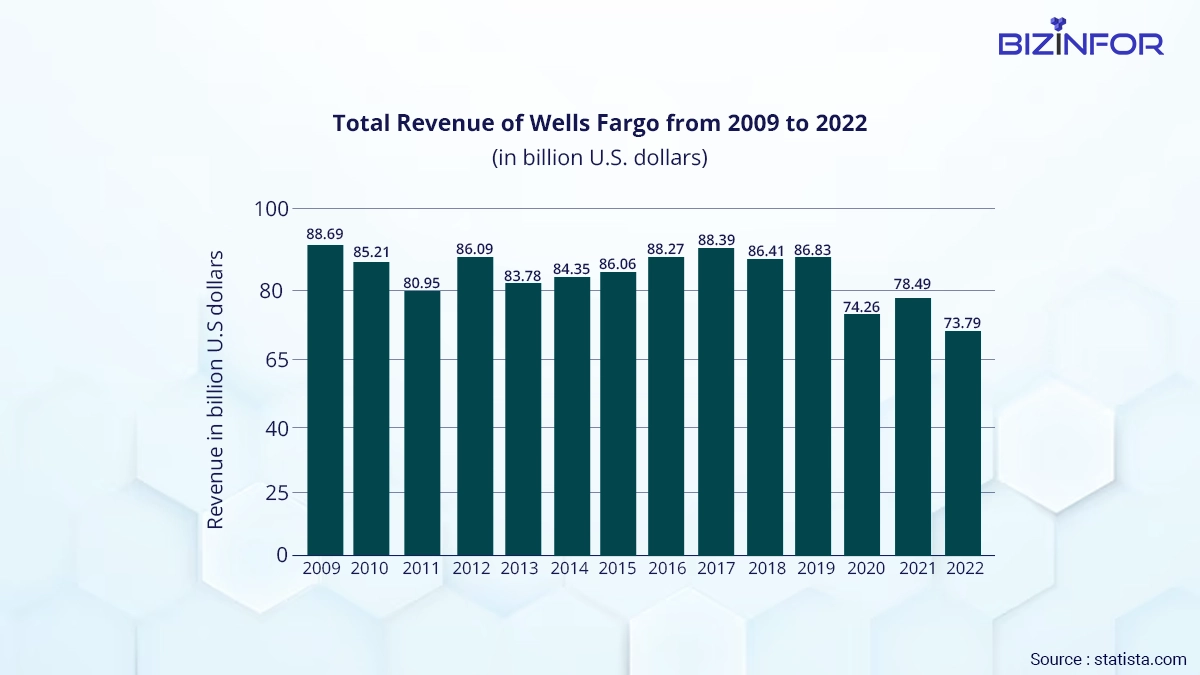

Wells Fargo & Company

- Headquarters: San Francisco, California

- Market capitalization: USD 162.84 billion

- Revenue for 2022: USD 13.2 billion

Wells Fargo & Company is renowned for being a middle-market banking provider, having a solid hold among small and emerging businesses in the US. It is mainly a financial services establishment that offers banking services and makes investment decisions through various subsidiaries in the market.

Strengths

- Strong and established global presence for an expansive reach in the market

- Holds an influential position among the top 4 banks in the US with the power to affect policy decisions

- Future-ready with substantial investments in environment-friendly businesses

- Great reputation in the market, owing to an earlier collaboration with PayPal for enabling donations to COVID-19 patients

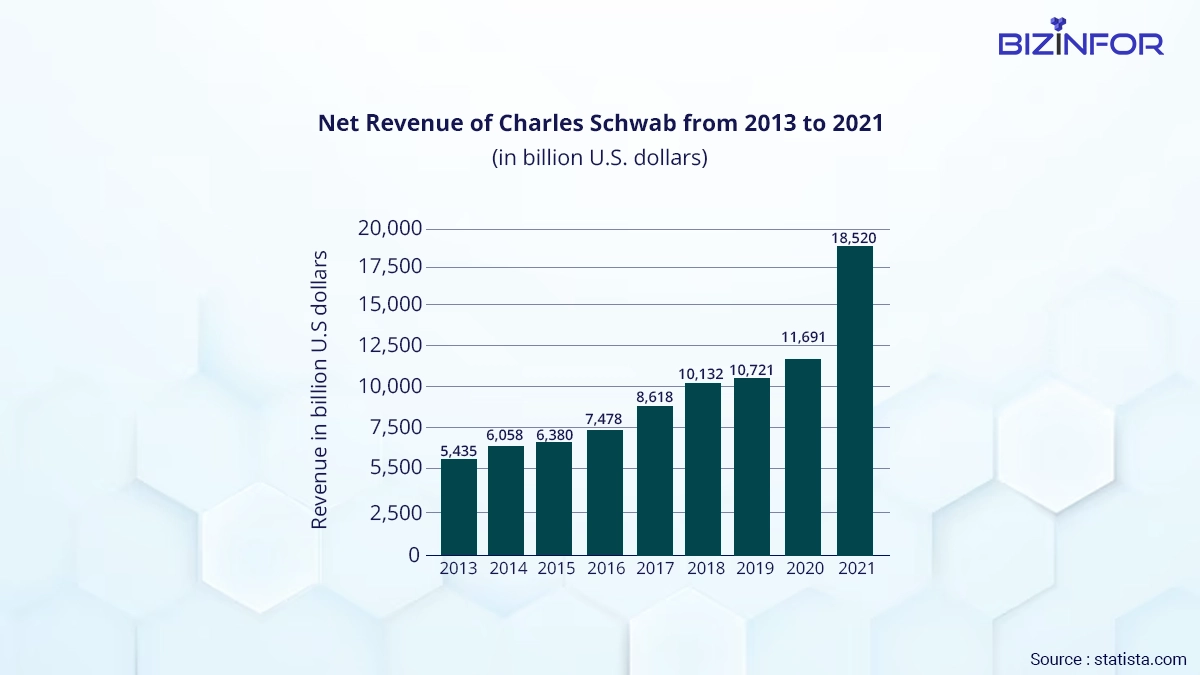

The Charles Schwab Corporation

- Headquarters: Westlake, Texas

- Market capitalization: USD 105.5 billion

- Revenue for 2022: USD 20.8 billion

Counted among the top financial companies in the USA, The Charles Schwab Corporation operates in multiple markets. Their services include securities, brokerage, banking, financial advisory services, and money management. It offers a host of investment solutions to ease users into the financial markets.

Strengths

- Strategically distributed branch offices throughout the USA

- Investments in multiple domains lead them less prone to losses due to market fluctuations

- Reputed as a discount broker with an extensive userbase

- Robust operational structure with insightful asset-liability management practices

Morgan Stanley

- Headquarters: New York

- Market capitalization: USD 144.31 billion

- Revenue for 2022: USD 53.7 billion

The market focus of Morgan Stanley lies in providing and enabling transactions in the equities space for organizations worldwide. It offers investment advice and executes trades for institutionalized clients in stocks, exchange-traded funds (ETFs), and global depository receipts.

Strengths

- Strategic distribution of different divisions – Institutional Securities, Wealth Management, and Investment Management for streamlined customer experiences

- Reputed force in the market with roots dating back to 1935

- Presence in over 40 countries worldwide

- Consolidated automation structure for increased efficiency and productivity

The Goldman Sachs Group, Inc.

- Headquarters: New York

- Market capitalization: USD 108.58 billion

- Revenue for 2022: USD 47.37 billion

Goldman Sachs is primarily known for providing investment banking and management services to individuals and corporations worldwide. It is one of the top financial companies in the USA, dealing with securities and other financial services aimed at different segments of society.

Their emphasis on technological innovations and global consistency make them one of the most reliable institutions in the world.

Strengths

- Place an increased emphasis on research and development

- Global market presence with high visibility

- Responsible and committed upper management who emphasize business growth through constant innovation

- Secure financial position with a strong cash flow

American Express Company

- Headquarters: New York

- Market capitalization: USD 130.39 billion

- Revenue for 2022: USD 52.86 billion

American Express is an integrated payment company with unique customer experiences and services. The target market for this organization is individuals and other institutions, as it offers credit cards and payment processing technologies and assists in making travel experiences better.

Strengths

- An inclusive company culture with dedicated training programs for employees

- Increase in net revenue over the years

- Diverse credit card schemes to cater to different segments of society

- Global reputation as a secure and efficient brand

S&P Global, Inc.

- Headquarters: New York

- Market capitalization: USD 127.33 billion

- Revenue for 2022: USD 11.18 billion

S&P Global is a surprising name on the list, known for offering credit ratings, analytics, and benchmarks in the global market. Additionally, this company provides customized workflow ratings for different companies and helps power financial decisions.

Strengths

- Cultivated a strong brand portfolio over the years

- Commitment to new projects with strong cash flow

- Personalized relationships with distributors and dealers

- Among the leaders in driving product innovation

BlackRock, Inc.

- Headquarters: New York

- Market capitalization: USD 103.87 billion

- Revenue for 2022: USD 17.87 billion

Counted among the leading assets management firms in the world, BlackRock also offers diversified services across investment banking and risk management. Furthermore, it enjoys an advisory position with some of the leading firms in the USA.

Strengths

- Holds assets worth USD 9 trillion

- Stronger market dominance after merging with Barclays Global Investors

- Caters to clients in over 60 countries

- Efficiency in operation has led to an economy of scale in the organization

The Blackstone Group Inc.

- Headquarters: New York

- Market capitalization: USD 68.41 billion

- Revenue for 2022: USD 6.8 billion

As an alternative investment firm, The Blackstone Group provides tailored services for individual investors and small and enterprise businesses. It also has strong positioning in the real estate market and regularly provides clients with assets management and capital market services.

Strengths

- Increased emphasis on research and development

- The promising flow of capital expenditure due to a history of successful project executions

- Strong brand portfolio with investments in different companies

- Respectable cash flow with no debts

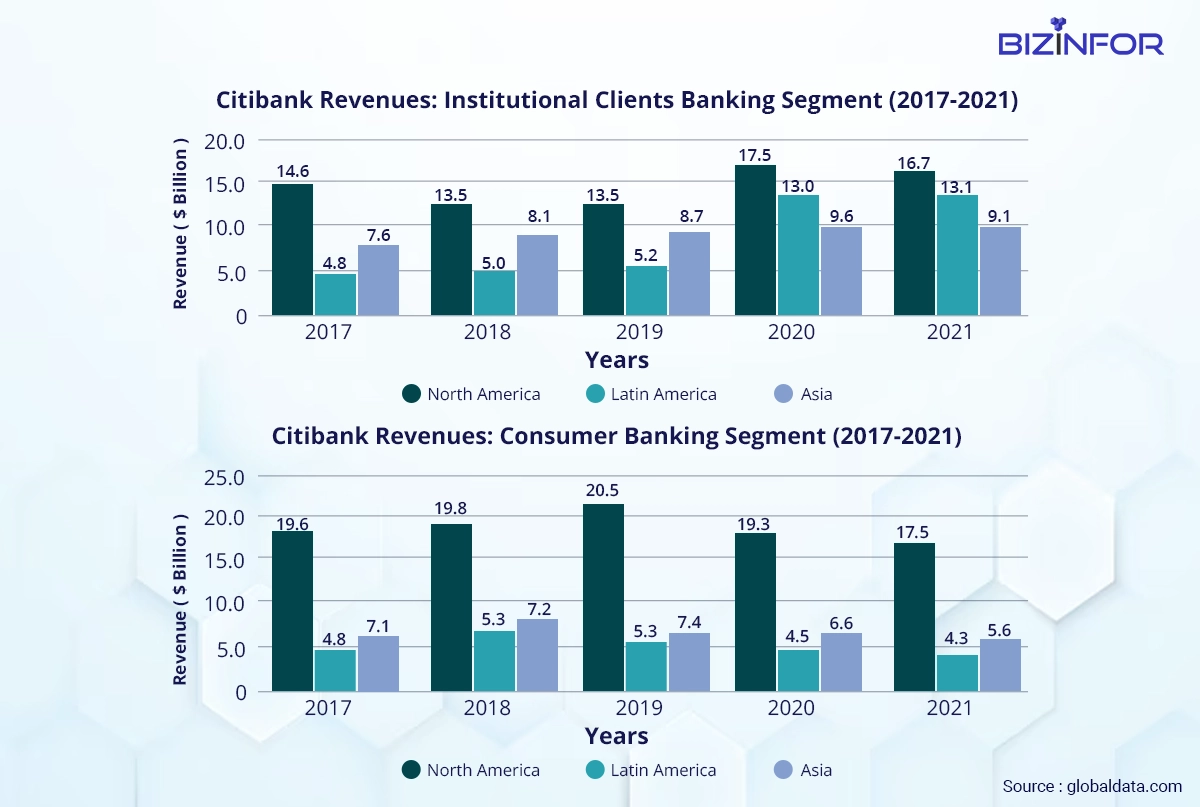

Citigroup Inc.

- Headquarters: New York

- Market capitalization: USD 90.99 billion

- Revenue for 2022: USD 14.8 billion

Citigroup is one of the most recognizable brands in the world, complete with a host of commercial and personal banking services. Some services include accounts and deposits, small business banking solutions, debit and credit cards, and loans and mortgages.

Strengths

- A diverse business portfolio that appeals to multiple groups

- Significant social media presence to boost visibility

- High level of automation to increase efficiency in internal operations

- Skilled workforce hired through a carefully-curated recruitment process

Marsh & McLennan Companies, Inc.

- Headquarters: New York

- Market capitalization: USD 91.73 billion

- Revenue for 2022: USD 20.7 billion

Marsh & McLennan Companies is a leading professional services firm that offers consultations on risk management and strategic investments. With a workforce of over 85,000 employees involved in different areas, the company provides inclusive solutions for organizations.

Strengths

- Free cash flow with minimal debt

- A strong network of suppliers

- Established clientele with a significant number of Fortune 1000 companies

- Consistent revenue growth

Summing Up

The largest financial companies in USA are involved with several aspects of financial management, ranging from assets management, banking services, and risk advisories. Together, they create a strong portfolio and offer streamlined solutions for all investment-related problems in the USA. Consider and compare the strengths of these prominent financial companies to decide the right fit for your financial needs.